Bankrate scores are objectively determined by our editorial team. Our scoring method weighs several things customers should really look at when choosing fiscal products and services.

Today EMI is often a preferred means of spending off loans mainly because it saves the borrower from your force of having to pay all the loan amount of money in a single go. Now that we comprehend the EMI this means let us know how it really works.

Bankrate scores are objectively determined by our editorial workforce. Our scoring system weighs numerous things people need to take into consideration when choosing monetary services.

Veteran Credit card debt Assistance can help you check out choices to decreased your regular monthly payments and acquire out of financial debt. We evaluate your monetary predicament and connect you with an answer that most closely fits your requirements.

LightStream loans are most effective for borrowers with outstanding credit history scores who will need bigger loan amounts and longer to pay for the loan off.

If no Local Lenders can be found, a Regional Lender will probably be displayed; a Regional Lender can be a lender who operates within the house state you chose and as much as 20-five encompassing states. Finally, if no Neighborhood or Regional Lenders are available, a Countrywide Lender will probably be displayed; a Countrywide Lender operates in all twenty-six states or maybe more. In case you’d want to see an alternate lender in addition to the lender(s) shown, it is possible to pick out other choices or return to our kind on A different event. HOW IS MRC Paid out? Lenders pay MRC to be exhibited. Payment isn't going to influence how prominently or how often a lender is shown. MRC’s community won't consist of all lenders or loan items offered inside the Market. MRC won't endorse any lender. The choice of a lender is a crucial one particular and shouldn't be dependant on advertising by itself. Close Modal

A person technique is establishing a transparent repayment strategy for virtually any money borrowed. This program really should outline specific timelines and quantities, making sure that administrators continuously repay their loans to the corporation. Setting up automatic payments by way of on line banking platforms can facilitate this process.

NMLS #491986 () Shut Modal

The most effective lower-interest personalized loans generally present starting up costs under ten per cent to borrowers with outstanding credit history and solid funds. Most minimal-interest level lenders present their most affordable prices for shorter conditions provided that you qualify for the upper payment. Read far more

Benefits of the USDA Dwelling Loan The USDA Loan is really a house loan alternative available to some rural and suburban homebuyers. USDA Property Loans are issued by skilled lenders and certain by The us Division of Agriculture (USDA). USDA Residence Loans are particularly favorable to These residing in rural or lower-cash flow regions. USDA Loans supply $0 dollars down, lenient eligibility specifications and aggressive fascination costs - because of the loan staying assured with the USDA. USDA home loans stand on your own as the sole mainstream zero dollars down software accessible to borrowers which have not served inside the armed forces. Qualified borrowers will probably be hard pressed to find a home loan plan which offers a lot more favorable read more phrases. 0% Down, 100% Funding USDA Loans are one of the last 0% down mortgages with 100 percent funding, resulting in minimal out-of-pocket expenses. Additional Households Now Qualify The USDA's definition of "rural" is largely liberal, indicating a lot of in small towns, suburbs and exurbs of main U.S. metropolitan areas fulfill the "rural" prerequisite. Lenient Demands USDA Loans are designed to provide homebuyers with lenient eligibility demands that assistance very low to average earnings people buy a home.

Any time you click on Join waitlist you'll obtain affirmation that you will be about the list. You will also be given the option to go away the waitlist. You're going to be notified through e-mail when your loan is prepared.

The commonest secured loans are mortgages and car loans. In these illustrations, the lender retains the deed or title, and that is a illustration of ownership, until the secured loan is entirely paid out. Defaulting over a home finance loan typically ends in the lender foreclosing on a home, when not having to pay an auto loan implies that the lender can repossess the car.

It’s imperative that you talk to the most recent guidelines from HMRC or maybe the suitable tax authority to find out the appropriate amount, as these can fluctuate in response to financial circumstances.

These choices feature sizeable danger. When you fall short to pay for down the equilibrium within the set introductory interval or within the set variety of payment installments, you could be billed an astronomically higher fee.

Judd Nelson Then & Now!

Judd Nelson Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Katie Holmes Then & Now!

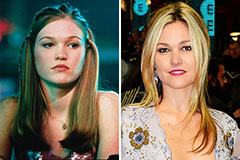

Katie Holmes Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!